Social Financing: A Solution to Growing Student Debt?

By Neal Modi | April 3, 2012 | No Comments

At colleges and universities today, there are intense campaigns, coordinated by young alumni and graduating students, to see that fellow (and former) peers donate back to their school.

I, for instance, a fourth-year at the University of Virginia, was recently asked to donate $20.12 to the University as a parting gift of sorts. They even allowed me to name the club, non-profit academic center, academic department, or school I would like to donate my money to. Certainly, I found this absolutely necessary. Cognizant of the decreasing funds our public universities are receiving from our Commonwealth, I immediately asked that my small gesture be donated to the College of Arts and Sciences – the largest undergraduate school at U.Va. and the school from which I will graduate.

Yet, in hindsight, I was stricken by perhaps the one-sidedness and even ineffectiveness of my gesture. While it is certainly the case that our departments and schools need critical funding, I asked myself about the students who make up the university in the first place? In an era where collective student debt in the United States exceeds $1 trillion, why could I not donate my $20.12 to a student fund dedicated to paying for current or future students’ tuition and college-related expenses?

While I am not the first to think of the idea, the uniqueness and value of such a concept could certainly reform the escalating student debt students’ today face.

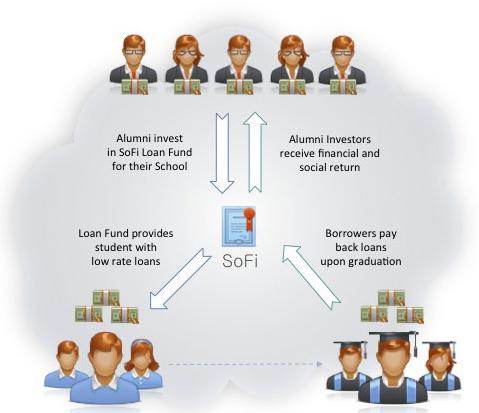

SoFi (or Social Financial) is a private enterprise that has done just that. The mission of the California-based venture is to “restore the historical norms of community finance to help students meet their financial needs through alumni involvement.” In other words, SoFi, operating on the premise that the $1 trillion student loan market is flawed, offers students a way to receive a lower loan rate than private or federal counterparts but with the concomitant benefits of connections formed via alumni, who are the investors. As a result, these alumni, many of whom have well-established careers, become involved in each students’ success. Moreover, SoFi guarantees alumni investors a return of at least 5 percent. (See the diagram below for how SoFi works.)

While SoFi cannot entirely reduce college tuition nor can it undercut the multitude of alternative private and state loan programs that currently exist, the social financial model provides a neat, innovative pathway for students. In a time when student loans are impersonal guarantees between a student and some bank, involving alumni, an untapped source of capital, can ensure needed connections and even a passageway to success after graduation. Most of all, it can ensure students have the opportunity to adequately pay back their loans.

Fortunately, this program has positive implications for our notion of justice too. Consider the stories of two students: one who had to finance her education entirely through loans and another who, through the good graces of his parents, did not have to take out a single loan.

Under the current, dominant student loan scheme, the first student would have to pay back her loans for a large part of her life. This in turn could affect what job she chooses to pursue or even the likelihood she buys a car, house, or other large investment in the near future. In fact, her student loans may serve as a gatekeeper to remaining in or entering the middle-class. And to make matters worse, given her background, her social connections are limited and her prospects after college, even though she may have been a stellar student, are not totally bright.

Meanwhile, in comparison, the latter student has no debt, a secure job (received through social connections of his parents), and no impediments to upward mobility. He has all the necessary connections — delivered in good faith by his parents — and the world is his oyster.

So what went wrong? The first student, who for sake of this example carried the same major and GPA as student #2, is not only burdened by student loans from the outset but also may have a difficult time paying her loans back since she lacks strong social connections to land a job.

While to some this is fair (after all, luck is an uncontrollable variable that plays such a large role in our lives), it reeks of injustice and flies in the face of the meritocracy our society purports to be. Thus, the social (or alumni) component of private loan schemes, like those of SoFi, mean more than just lower interest rates, it has the potential to, while providing a social good, equal the playing field. Put in simpler terms, social financing has the ability to mitigate luck or good fortune.

Fortunately, SoFi is spreading all across the nation and even will be opening financing opportunities for students at the University of Virginia, the College of William and Mary, and Virginia Tech, according to their website. But while it is great to see that our state’s flagship schools are included, it would be even better to see our Commonwealth’s other schools, whose students may comparatively have limited or weaker social connections, to be included as well.

Furthermore, it would not be an unwise decision if the schools themselves mimic what SoFi has done. With strong alumni connections already in place and the fact that alumni are probably more willing to donate directly to the school (with the potential of a return to their investment) as opposed to some private venture, it could be a wise decision to implement social loan financing at both our state’s public and private institutions. For instance, at the University of Virginia, the U.Va. alumni association maintains a website intended to connect students to alumni. This program, no doubt, could be further bolstered if alumni were financially invested in students.

Today, there is a student debt crisis looming and while social financing may not, in one swift motion, be its panacea, it can incorporate a necessary element to student loans: social connections and capital. After all, our notions of justice and meritocracy depend on it.

Disclaimer: The opinions expressed in this post are those of the author, and do not necessarily reflect those of members of the NDP Steering Committee.